What was the rationale behind the launch of Starzplay?

There were two underlying pillars. First, pay-TV, in this part of the world, was under-penetrated. Anywhere else in the world, there’s a whole range of pay-TV service providers, some selling $60 packages, others going as low as $10. Here, you didn’t have that. On one hand, you had MBC beaming into 50-60 million homes every night – very successful as a free-to-air broadcaster. Then, on the other extreme, you had packages from OSN that started at $60-70/month, which is very expensive outside of the UAE, especially in North Africa and Egypt. At the same time, customers were willing to pay for premium content and service. So, our original hypothesis was that there was a gap between consumer demand and what the industry was offering here. Secondly, with only one or two players in the market, studios were not able to sell and monetize all their content. So, you had demand that was unaddressed, and you had a supply of content that wasn’t being fully monetized.

Then, there were two very favorable trends: the region has an extremely young population: yet, these customers were being offered the same old content. Essentially, the industry lost these customers to YouTube – that’s why YouTube has been so successful in this part of the world. The second trend is that infrastructure in this part of the world was also coming of age. When we were first getting started, we were told that the region was not ready; the infrastructure wasn’t there. This is one thing that the entertainment industry was grossly underestimating. In the Gulf, the fixed broadband infrastructure was definitely ready. Meanwhile, markets like Egypt and North Africa were essentially leapfrogging – not deploying fiber to the home but launching 4G networks.

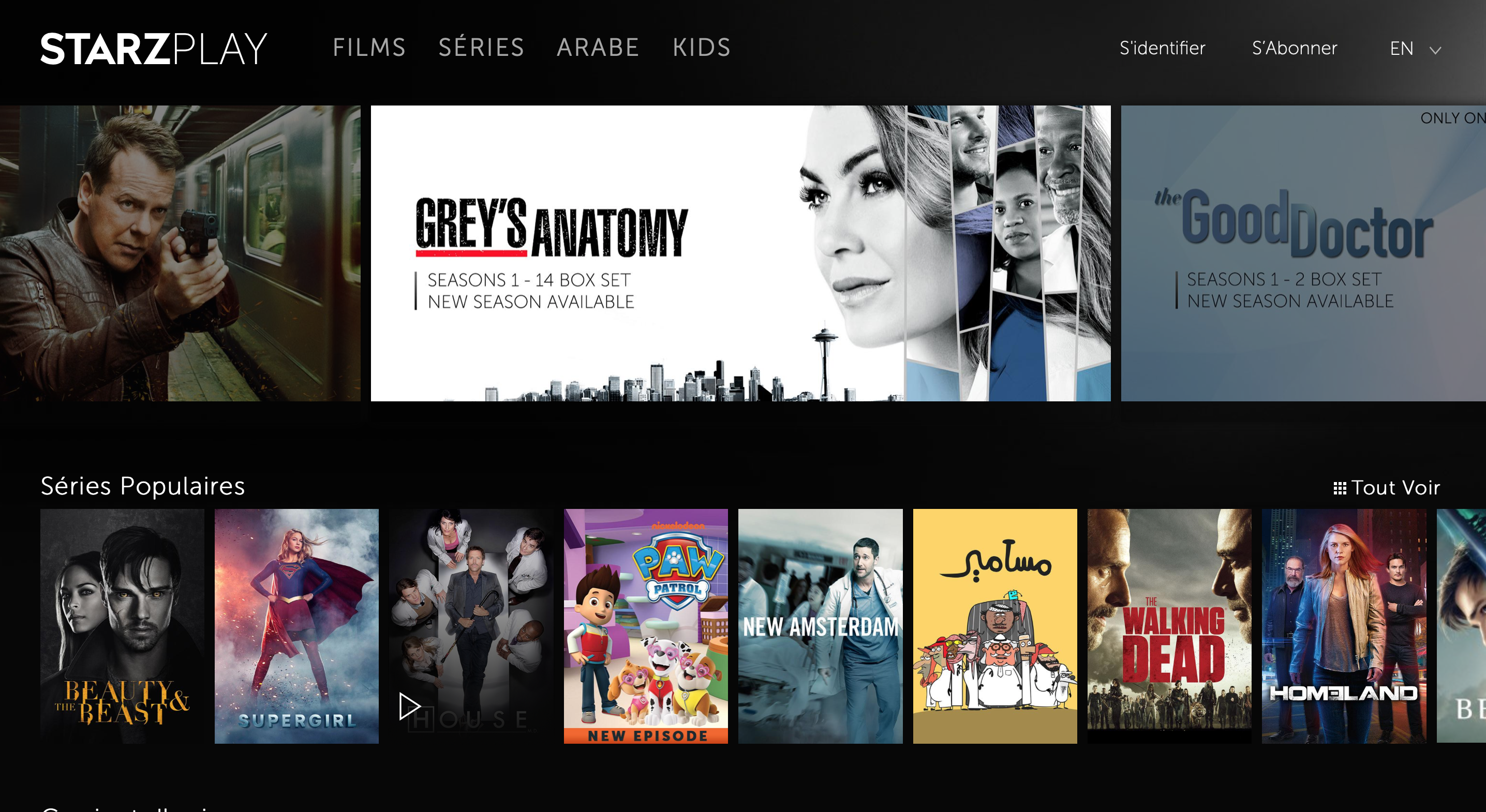

The combination of all these factors led us to think that the way to bring it all together was to launch a premium digital streaming service experience, ads-free, with the latest movies and TV shows, in an affordable way.

Why did you opt for a subscription-based revenue stream model?

Our experience in this region showed us that there’s a willingness to pay for two things: premium content (exclusive, newer, unedited) and ads free. That’s the core proposition of our service. We had about 1.25 million paying subscribers as of end-October. By end of 2023, we estimate there’s going to be about 10 million paying OTT subscribers in the market, and we want to have about 30% of market share – which is what we have today.

Who are your competitors?

It’s definitely Netflix today, primarily because our strength has been premium Hollywood content. Shahid has been very strong in Arabic, so we don’t see them as direct competitors just yet, but rather as a complimentary service. We estimate that 60% of our users subscribe to more than one service; they might be subscribing to Netflix or to Shahid.

How have you been growing your partnerships with telecom companies in the region?

When we first launched the service, we started with the assumption that we have great content, that we will extend credit card as a method of payment, and that subscribers will come. We turned on the service and waited for thousands of people to sign up. We learned the hard way that the willingness to use a credit card online is low in the region and that credit card penetration outside of the UAE is extremely low. We quickly adjusted and created an ecosystem of payment solutions. While Netflix is not integrated with a single telco for mobile payment, Starzplay is integrated with 22 different telcos. We have a team that’s dedicated to working with telcos on that integration. Not only that, once you start working with the likes of Etisalat or Saudi Telecom, you’re dealing with very large organizations. Basic integration is perhaps step one in a 20-step journey to extract the real value, but you have to earn your stripes. We started with Etisalat as a simple payment option and then they started to see the volumes build on it, so they agreed to take step two and expand the relationship. Now, we’re hard-bundled with Etisalat.

How do these partnerships work financially?

The telco keeps anywhere from 10 to 30% of the subscription, depending on the role they played in acquiring the customer. As a service provider, I can spend my money on digital marketing channels, advertising on Google, Facebook or YouTube to acquire customers; or I can decide that my telco partner is going to bring me that customer. I will share that value with Etisalat, rather than with YouTube or Google. As long as the acquisition cost for Starzplay is better or neutral, I’d much rather work with the regional telcos. About 50% of our total subscription base come from these partnerships, this is our biggest growth channel.

How do you view the growing number of competitors?

When Netflix was first going to launch in the region, I probably didn’t sleep for a whole week. But once they launched, our numbers started to improve. When a big player like Netflix enters the market, it creates awareness. Of course, it’s challenging for us. But it has brought a lot more recognition to the industry.

How are you planning to diversify your revenue stream?

There are certain markets where we can create value by bringing the full Starzplay service to the consumer with our content, our marketing, our apps – essentially, we are taking the whole risk of bringing that service to the consumer. MENA and Pakistan fit into that model. There are other markets where we can create more value, not by competing as a B2C service, but rather by licensing our platform to an existing broadcaster or a telco like Vodafone India. Platform licensing has started about three months ago, when we launched successfully in India. That revenue stream started but it’s small, but I see it gradually growing in the coming years.

The second part is getting into original content and product placement. I see product placement as a means to share part of our original programming costs with another advertiser – de-risking our investment in original content a bit. But where the serious revenue comes in is, if you’re successful in producing shows, customers come to your service. That’s when the value kicks in.

What are the challenges of going into original content production?

Arabic content is a complex for lots of reasons, one of which being that the MBC, Abu Dhabi TV and Dubai TVs of the world here, and the Annahar and CBC in Egypt, are all extremely successful in what they do, and the customer doesn’t pay for it. We cannot take similar content and put it on our service because people are not going to pay for that. So, how do you create content that moves people away from them and onto your service? Number two, the entire industry has been very conditioned – from the scriptwriters to the showrunners, the producers, the directors… I might have the perfect script or idea, but I might not have the ability to execute, especially as a small player. And the third challenge is that what might work in the Gulf might not work in Egypt, and certainly won’t work in Maghreb. So, how can you create a pan-regional show or content that appeals to everyone? I’m not sure we’ve solved that puzzle yet.

As a regional player, can you afford not to have more Arabic content, though?

Absolutely not. When you enter a market that has low pay-TV penetration and is under-monetized, you can scale to half a million or one million customers on the heels of the premium Hollywood content that wasn’t previously available. That’s where we are today. But if we’re going to go from 1.2 million to 2.5 million customers, the next million has to come from locally-created original content that speaks to a much wider audience and caters to their needs that have been unaddressed so far.

How do you see the market evolving?

In most markets, when Netflix launches its service, it takes about three to four years to reach 30% penetration of broadband homes. If you apply the same metric to the OTT industry here, the fixed broadband homes alone would be 10 million. And right now, the industry is about to two million. But the real upside is mobile broadband. The number of 4G customers in MENA alone is expected to be between 75 million and 200 million. If you start looking at just 10% of penetration of that, you’re talking 10 million additional customers. So, we have much room to grow.

What does the rise of OTT mean for traditional TV?

The question is, can the linear television industry adjust to the new model? Will the OTT industry kill linear TV? The answer is no. But traditional TV might kill itself if it doesn’t adapt.

Back

Back